KRYTON Metals Blog

Why Steel Costs Are on the Rise and What to Expect Entering 2021

It goes without saying that 2020 was a challenging year. As if a worldwide pandemic wasn't enough to put a damper on the economy, a contentious presidential election added to the turmoil. With the uncertainty surrounding the timeline and effectiveness of vaccines and a new administration in Washington, it's hard to make any concrete predictions for 2021.

Steel prices retreated in 2020 as lockdowns and business disruptions lowered the demand and price for this essential commodity used in the construction, automotive, and other engineering industries. One major bank has estimated that approximately 9.4 million tons of steelmaking capacity were temporarily closed during parts of the pandemic, but demand also plummeted, as did the price.

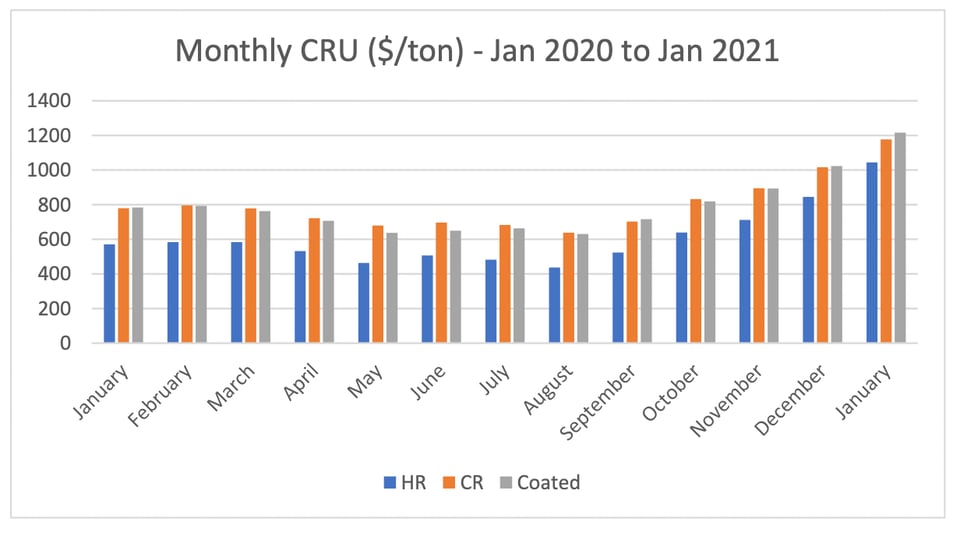

As 2021 begins, steel prices are now on the rise. According to SMU, the price of hot rolled steel reach a record high of $1,080 per ton in January, passing the previous high of $1,070 per ton in 2008.

Why are steel costs now on the rise?

A relatively rapid recovery in the latter months of 2020 drove the price of hot-rolled coil steel up more than 50 percent from its low point in August. An imbalance between steel supply and demand might be the primary contributor to the rising costs of steel, but it is not the only factor. Other contributing factors include higher overhead expenses because of COVID-19 safety protocols, increased freight charges and a shortage of shipping containers as a result of higher demand, and lower capacity utilization.

However, one need look no farther than increasing demand as the cause of rising steel prices. During the pandemic, steelmakers made significant production cuts, while distributors and manufacturers allowed their inventories to fall to critically low levels. As demand has stepped up, metal fabricators and others who produce metal products are looking to re-supply but are discovering that steel mills do not have material to sell. Until steelmakers can increase their output to meet the present demand, steel prices will continue to move higher.

When can manufacturers expect steel costs to stabilize?

Most analysts believe that steel costs will reach their peak by the end of the first quarter of 2021. A downtrend for the rest of the year should follow. At the same time, some are warning that because of the higher-than-expected prices at the start of 2021, overall price forecasts for the coming year have been revised upward from recent projections. If production and imports don't increase, or if consumption doesn't decrease, creating a more stable supply and demand, prices could continue to rise in future 2021 quarters.

Surveys indicate that steel buyers believe the market will peak in February. While there is now a second consecutive month of major price increases to put markets at record highs, there is thought that many markets are at or near their peak. With those who watch the steel industry's workings already revising their predictions farther into the future for stable prices, however, a February peak might now be overly optimistic.

What should manufacturers know about the steel market in 2021?

Steel prices in the United States had plenty of momentum going into 2021, resulting from steel supply shortages, rising scrap prices, and a sharp increase in demand. Forecasts made in December predicting US HRC metal prices would average more than $900 per ton in the first quarter of 2021 have already been exceeded as prices have eclipsed the $1,000 per ton mark.

Elevated finished steel prices and heavy demand will induce blast furnaces to restart and increase imports in the near term. Still, these supply increases are not expected to slow the momentum that steel prices had before the end of the first quarter of 2021.

Experts predict that a fully adopted Covid-19 vaccine by mid-2021 will cause a significant shift in consumer spending. Manufactured goods will give way to travel, services, and experiences, initiating a substantial release of repressed demand in the second half of 2021. But even while consumer demand for manufactured goods recedes, manufacturing and demand for steel will continue unabated as businesses replenish inventories throughout the supply chain.

How could the overall economy fare in the face of rising steel prices?

While the shift in consumer spending away from manufacturing to services, experiences, and travel will temporarily decrease the consumption of steel-containing goods, the transition should positively affect overall economic growth and expansion. The recovery should affect the total U.S. economy in 2021, creating greater sustainability than the split economic recovery of 2020.

KRYTON Metals is an ISO-certified manufacturer of spun metal components and fabricated parts across a number of industries